| |

| Source |

I am so stressed out about money at this point in my life. Three years ago, I had no debt for the first time since I was 18 years old. This only lasted a matter of months before I took out an unconventional personal loan to attend a convention for the television show Supernatural. My bank wouldn't loan me the money because my credit was still so poor, but I was advised to take a loan if anyone would give me one because it would help my credit score. I took an unsecured loan from a credit card company with a completely ridiculous interest rate of 36%. Since then, my spending has spiraled out of control and I have racked up so much debt that it's hard for me to survive. I don't know what I would do if I didn't have Matt.

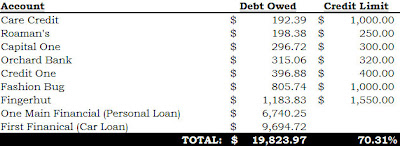

I'm embarrassed to post this, but I think that if I do, it will help me follow my goals for the remainder of the year because other people will know what I'm keeping secret... Please no harsh comments... I know how terrible it is to be this much in debt. So, here is my current debt as of 10 am this morning:

|

| Click on the picture to make it bigger if you cannot read it. |

I spent some time looking into Dave Ramsey's method of getting out of debt and I believe that it makes sense. Your first goal under his method is to have $1000 in your savings. Once you achieve that goal, you start to "snowball" your debt. This means you pay of your account with the lowest amount owed and work your way up until you have paid them all off. This is the reason why my credit accounts are listed smallest to largest. After that you try to save up three to six months worth of bills into your savings. For me, this would be $2700 to $5400...

This past weekend, I spent several hours working out my budget for the next year.I put my paycheck each month at the top and then wrote down each bill due each paycheck. I included minimum montly payments on all of my accounts for the next year. If I don't need to apply that money to my credit account, then I will apply it to the next debt on my list until all are paid off. Doing my budget made me realize how little money I will have for the remainder of the year... I honestly don't know how I will be purchasing Christmas presents for anyone this year... Maybe I will be creative and make things for people...

Anyway, I will be barely getting by until I get my bonus at the end of the year (last paycheck of the year). People always say, don't count on bonuses, but this one I can count on as I've earned it. My boss tries to reward people who don't call in all the time by offering a bonus at the end of the year. Basically it is cashing in all of your sick time instead of just losing it. In five years, I have only called in once so my "sick bonus" is pretty much a definite. You're actually better off not calling in because my boss only pays you 60% of your pay when you call in. Your first year of no call ins, you get $500. Each subsequent year you don't call in, you get an additional $100 added onto the $500. After taxes, my take home bonus this year will be about $425. All of this will be going directly to my savings. Then I will be broke again until I get my tax return back in mid-February. Once this happens, I will be able to get my $1000 in savings and then I should be okay.

The hardest part is going to be not spending what I have open on my credit cards. I have already removed everything that I used to have directly billed to any of my credit cards. Those items now are directly withdrawn from my checking account. I suppose I should probably go to my PayPal, Amazon account, etc... and remove all cards except my debit card. Then I should take all of my cards except my debit card and care credit card (for unexpected health related expenses) out of my wallet and store them somewhere. I don't want to get rid of them in case I need them for anything important. It's going to be tough, but I'm adamant to make this happen.

Your Thoughts:

- Have you ever been in debt? Are you still in debt? If not, how did you get yourself out of debt?

- Do you have any advice (not lectures) that may help me while struggling to get out of debt?

YES!!!! I find it so brave of you to post something so direct! I'm working my way out of debt too. One of my tricks (and it's not a big one) is to use my credit card to earn miles and use the miles to help pay off the credit debt but also to pay off a little extra each time. For example, when I charge something that costs $8.00, I IMMEDIATELY from my phone pay off that amount, plus another dollar or two. (Does that makes sense?) Basically, I will charge 8 dollars but pay the bill for the amount of 10 dollars. Each little bit extra counts towards reducing the amount that I owe towards my visa bill. Using my credit card earns me points which I can apply towards paying off my bill. What works for me is paying it off right away-not at the end of the month, not the end of the week or even the end of the day-I literally pay transfer the money and pay it off right away.

ReplyDeleteI wait until I have at least $100.00 in miles before I use it towards the bill.

Good luck! (I hope this didn't come off lecture-y!)

that is a good plan. :) you can do it.

ReplyDelete